Finding out how much insurance discount anti-theft device options can offer is a smart move for car owners. It’s a common question: how much can you actually save by installing an anti-theft system? The answer isn’t always straightforward, but we’ll explore all the factors that influence those savings. how much insurance discout anti-theft device It’s not just about the device itself, but also your car, your location, and your insurance provider.

Understanding Anti-Theft Device Insurance Discounts

Anti-theft devices can significantly reduce your car insurance premiums. This is because they make your car less likely to be stolen, which in turn reduces the risk for the insurance company. The discount you receive depends on a variety of factors, including the type of device, your insurance provider, and your location.

Factors Affecting Your Discount

Several factors play a role in determining the size of your how much insurance discount anti-theft device offers. These include:

- Type of device: Basic alarms may offer smaller discounts than more sophisticated systems like GPS trackers or immobilizers.

- Insurance provider: Different insurers have different policies regarding anti-theft discounts. Some offer larger discounts than others. It’s crucial to shop around and compare quotes.

- Location: Areas with high rates of car theft may see larger discounts for having anti-theft devices.

- Car make and model: Cars that are statistically more likely to be stolen might qualify for higher discounts if equipped with anti-theft systems.

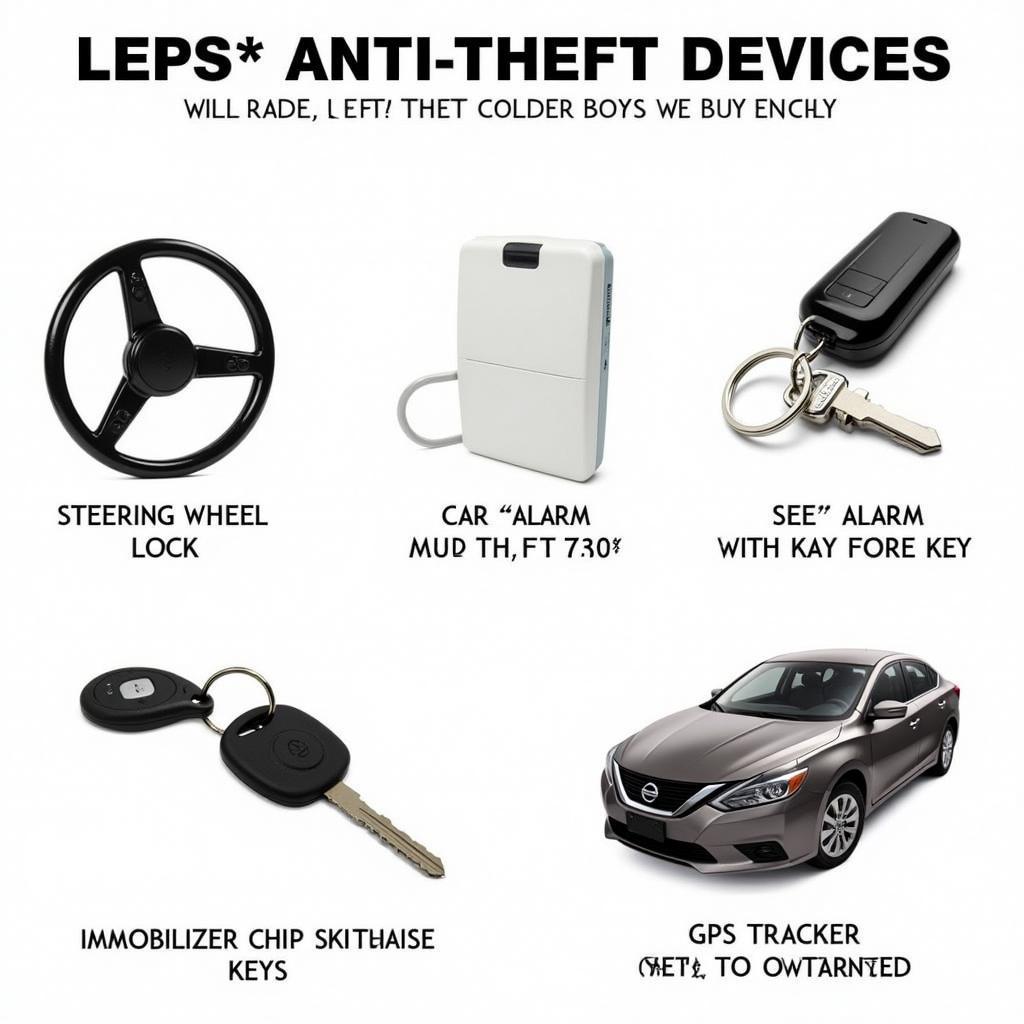

Types of Anti-Theft Devices and Their Impact on Insurance

Various anti-theft devices offer different levels of protection, impacting the potential discount on your premiums. is iunsurance lower if equipped with anti theft Here are some common types:

Car Alarms

Car alarms are a common deterrent, often offering a small discount on your insurance. They alert you and others to a potential theft attempt.

Immobilizers

Immobilizers prevent the engine from starting without the correct key, making it much harder to steal your car. These often qualify for a larger discount than a simple alarm.

GPS Trackers

GPS trackers can locate your car if it’s stolen, increasing the chances of recovery. This can lead to a significant insurance discount. is getting an anti theft system a good choice This added security feature is attractive to insurers.

Steering Wheel Locks

These visible deterrents can also contribute to a small discount, adding another layer of security to your vehicle.

Comparison of Different Anti-theft Devices

Comparison of Different Anti-theft Devices

How to Maximize Your Anti-Theft Device Insurance Discount

To get the most out of your anti-theft device, consider the following:

- Contact your insurance provider: They can tell you exactly which devices qualify for discounts and how much you can save. Don’t assume all devices are created equal in their eyes. how to know if my car has anti theft device Inquire about specific requirements and documentation they need.

- Shop around: Compare quotes from multiple insurers to find the best deal. Discounts can vary significantly, so it pays to do your research.

- Combine discounts: Some insurers offer discounts for multiple safety features, such as anti-theft devices and anti-lock brakes.

“It’s important to remember that the how much insurance discount anti-theft device question isn’t a one-size-fits-all answer,” says John Smith, Senior Automotive Security Specialist at SecureRide Systems. “It’s crucial to communicate directly with your insurance provider for the most accurate information.”

Is Getting an Anti-Theft System Worth It?

While the how much insurance discount anti-theft device offers can be a significant factor, the peace of mind it provides is invaluable. Knowing your vehicle has added protection is a major benefit. do i need a anti theft device for my jeep

Conclusion

Investing in an anti-theft device can be a wise financial decision. While the “how much insurance discount anti-theft device” question has a nuanced answer, the potential savings and increased security make it a worthwhile consideration. Research different devices, contact your insurance provider, and compare quotes to find the best solution for your needs.