When you’re trying to protect your car, an anti-theft device is a great place to start. Not only can it deter thieves, but it might also land you a discount on your car insurance. But how do you know if your device qualifies? Let’s break it down.

Understanding Anti-theft Devices and Insurance

Insurance companies love to see cars equipped with anti-theft devices because it reduces their risk. The harder it is to steal your car, the less likely they’ll have to pay out a claim. But not all anti-theft systems are created equal in the eyes of an insurance company.

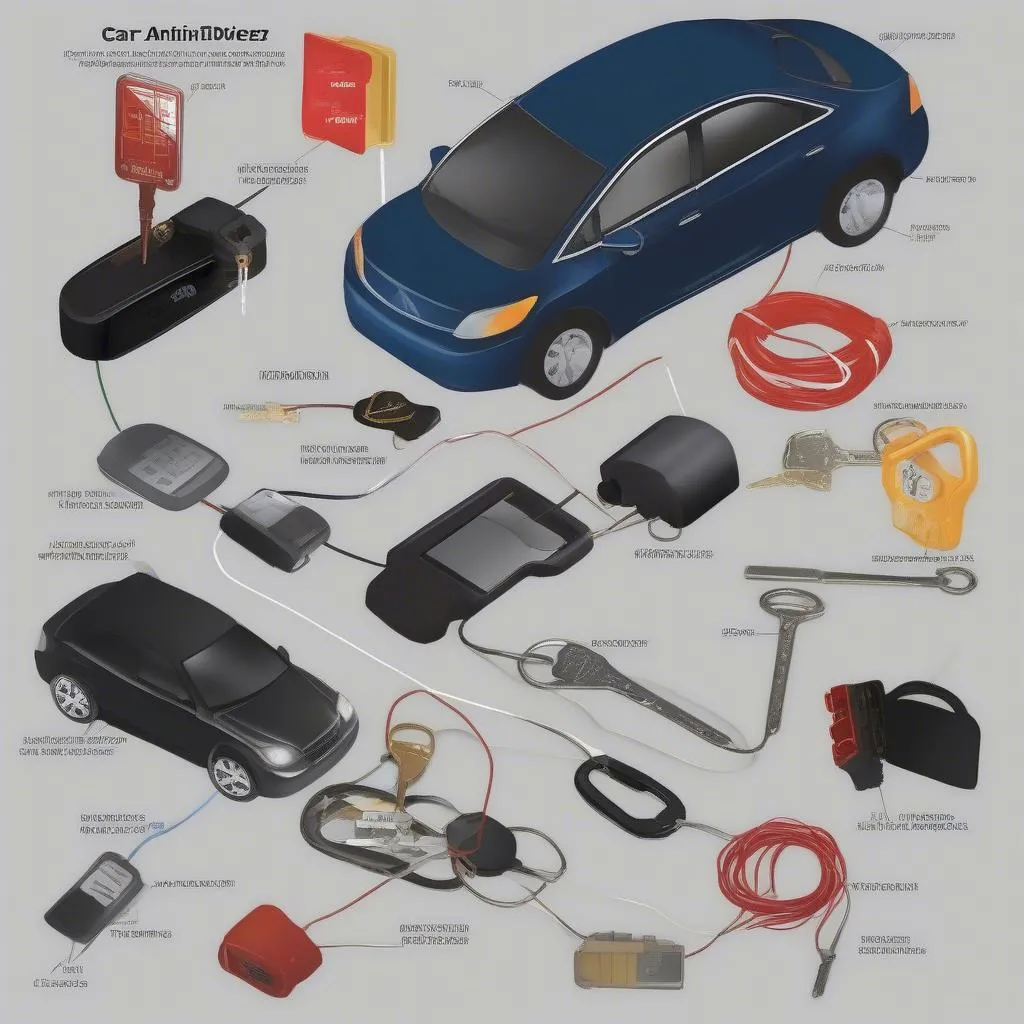

Types of Anti-theft Devices

There are two main categories of anti-theft devices:

- Passive immobilizers: These come standard in most modern vehicles. They work behind the scenes to prevent the engine from starting without the correct key. Think electronic key fobs and chip keys.

- Active immobilizers: These require driver activation and often involve a physical component. Examples include steering wheel locks, kill switches, and GPS tracking systems.

Different types of car anti-theft devices

Different types of car anti-theft devices

Finding Out if Your Device is Listed

Want to know if your anti-theft device makes the cut for a discount? Here’s how:

- Check your insurance policy: The most direct route is to review your policy documents. Look for sections related to discounts, safety features, or anti-theft devices.

- Contact your insurance agent: Your agent can quickly tell you if your specific device qualifies for a discount and how much you could save.

- Visit your insurer’s website: Many insurance companies have online resources that list eligible anti-theft devices and associated discounts.

What if My Device Isn’t Listed?

Don’t fret! Just because your device isn’t explicitly listed doesn’t mean you’re out of luck. Contact your insurance agent. They can guide you through the process and may offer alternative discounts based on your vehicle’s security features.

Contacting a car insurance agent to discuss anti-theft device discounts

Contacting a car insurance agent to discuss anti-theft device discounts

FAQs about Anti-theft Devices and Insurance

Here are some common questions we hear:

-

Q: Does a car alarm qualify for an insurance discount?

- A: While car alarms can deter theft, they are often seen as less effective than immobilizers. Some insurers may offer a small discount, but it’s not as common as discounts for more sophisticated systems.

-

Q: How much can I save with an anti-theft device discount?

- A: Discounts vary depending on the insurer and device, but you could potentially save anywhere from 5% to 25% on your comprehensive coverage.

-

Q: I’m installing a new anti-theft device. Do I need to inform my insurance company?

- A: Absolutely! Provide your insurer with details about the new device to ensure your policy reflects the added protection and you receive any applicable discounts.

Need Expert Help?

Navigating the world of car diagnostics and software can be daunting. CARDIAGTECH offers a range of cutting-edge diagnostic tools and services to keep your vehicle running smoothly. Learn more about our products and services.

Remember: Investing in a robust anti-theft device not only protects your vehicle but could also save you money on insurance. Contact your insurance provider today to learn more about your options.