When you’re investing in your car’s security with an anti-theft system, it’s natural to wonder about the financial implications. One common question is, “Is anti-theft insurable interest?” The answer is a resounding yes! Let’s explore why anti-theft systems matter to insurers and how they can benefit you.

Understanding Insurable Interest in Anti-theft Devices

Insurance is all about mitigating risk. For insurers, vehicles equipped with anti-theft systems present a lower risk of theft or damage. This is because these systems deter thieves and increase the chances of recovering stolen vehicles. This reduced risk translates into an insurable interest for the insurance company, and often, lower premiums for you.

How Anti-theft Systems Benefit You

Investing in a robust anti-theft system can lead to several financial advantages:

1. Reduced Insurance Premiums

Many insurance companies offer discounts on comprehensive auto insurance for vehicles with anti-theft devices. The logic is simple: a car less likely to be stolen is less likely to result in a claim.

2. Peace of Mind

While the financial benefits are undeniable, the peace of mind an anti-theft system offers is invaluable. Knowing your car is protected provides a sense of security and reduces worry.

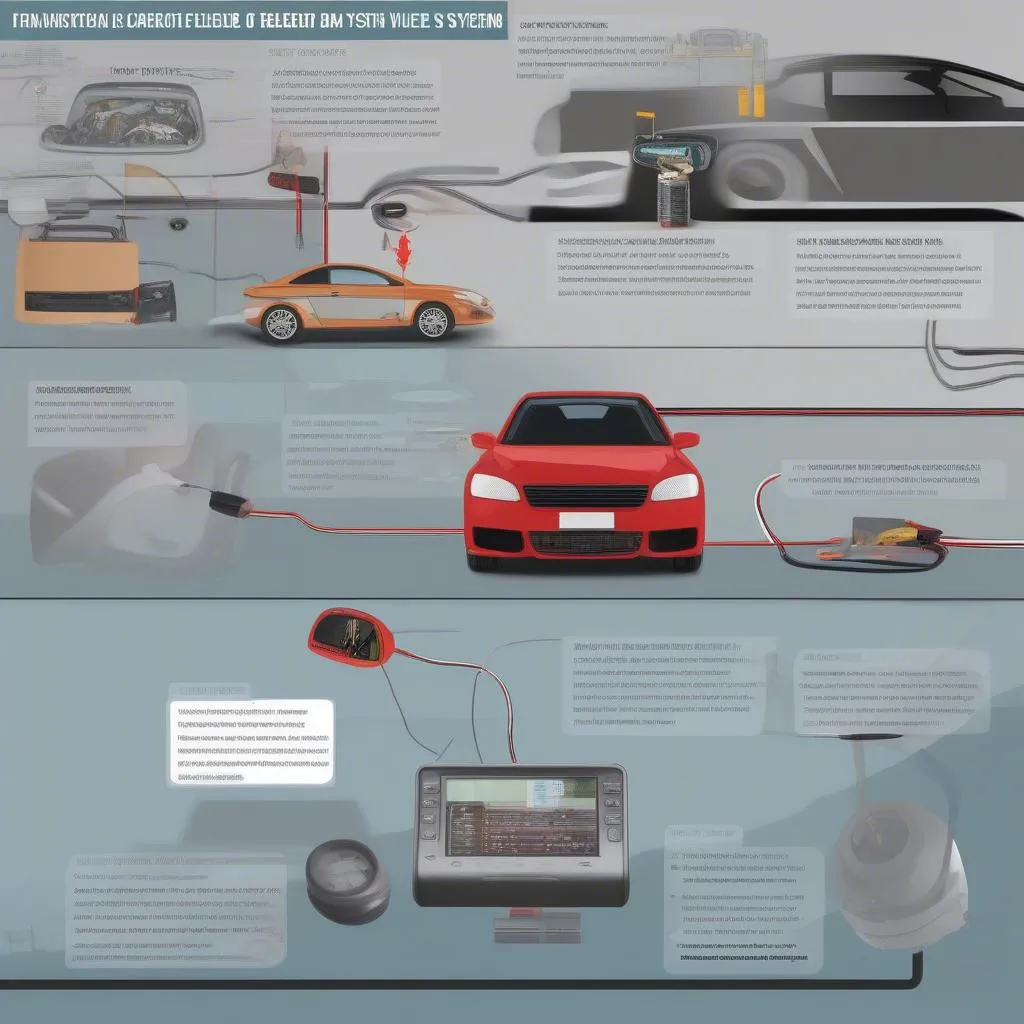

Car alarm system installation process

Car alarm system installation process

Types of Anti-theft Systems That Matter

Not all anti-theft systems are created equal. Insurance companies typically recognize and offer discounts for these types:

- Audible Alarms: These are the most common, emitting a loud siren to deter thieves and alert others.

- Immobilizers: These systems disable the vehicle’s starting system, preventing thieves from driving it away.

- Tracking Systems: These use GPS technology to help locate a stolen vehicle, increasing the chances of recovery.

Choosing the Right Anti-theft System

When selecting an anti-theft system, consider your vehicle’s make and model, your budget, and the level of security you desire. Consulting with a trusted mechanic or security professional can help you make an informed decision.

Expert Insight

“Investing in a quality anti-theft system is a smart move for both your wallet and your peace of mind,” says Robert Gallagher, a seasoned automotive security specialist and author of “Protecting Your Ride: The Essential Guide to Automotive Security.” “Not only can it lower your insurance premiums, but it also acts as a powerful deterrent against theft.”

![]() Mechanic installing a GPS tracker in a car

Mechanic installing a GPS tracker in a car

FAQs About Anti-theft Systems and Insurance

Q: Will any anti-theft system qualify me for an insurance discount?

A: Not necessarily. It’s essential to check with your insurance provider to see what systems they recognize and offer discounts for.

Q: How much can I save on my insurance with an anti-theft system?

A: Discount amounts vary depending on the insurance provider, the type of system, and your location. However, discounts can range from a few percentage points to a significant portion of your premium.

Q: Can I install an anti-theft system myself?

A: While some basic systems can be self-installed, it’s generally recommended to have a professional handle the installation. This ensures it’s done correctly and functions optimally.

Connect with Cardiagtech for Expert Diagnostics and Programming

Facing car troubles? At CARDIAGTECH, we offer a range of advanced diagnostic and programming services, including software installations and repairs, to keep your vehicle running smoothly. Contact us today for expert support and solutions.

Conclusion

Having an anti-theft system is not just about protecting your vehicle; it’s also about protecting your investment. By reducing the risk of theft, these systems provide you with peace of mind and potential financial benefits through lower insurance premiums. If you’re looking to enhance your car’s security and potentially save on insurance, exploring anti-theft options is a wise decision.