Understanding how anti-theft coverage discounts work with USAA car insurance can save you money and provide peace of mind. This comprehensive guide explains what anti-theft coverage is, how it impacts your USAA car insurance premiums, and how to maximize your potential savings. what is anti theft coverage with usaa car insurance

Understanding USAA’s Anti-theft Discount

USAA, like many other insurance companies, offers discounts to policyholders who install approved anti-theft devices in their vehicles. These devices deter theft and can help recover your car if it’s stolen, reducing the risk for USAA and justifying a lower premium for you.

This discount isn’t a separate coverage but rather a reduction in your comprehensive coverage premium. Comprehensive coverage protects your car from damage not caused by a collision, including theft. The anti-theft discount reduces the cost of this coverage, acknowledging that your vehicle is less likely to be stolen.

USAA Anti-theft Device Discount

USAA Anti-theft Device Discount

Many factors influence the exact discount percentage you’ll receive, including the specific device installed, your vehicle’s make and model, and your location. While it’s essential to contact USAA directly for a personalized quote, understanding the basics of this discount can help you make informed decisions.

Types of Qualifying Anti-theft Devices

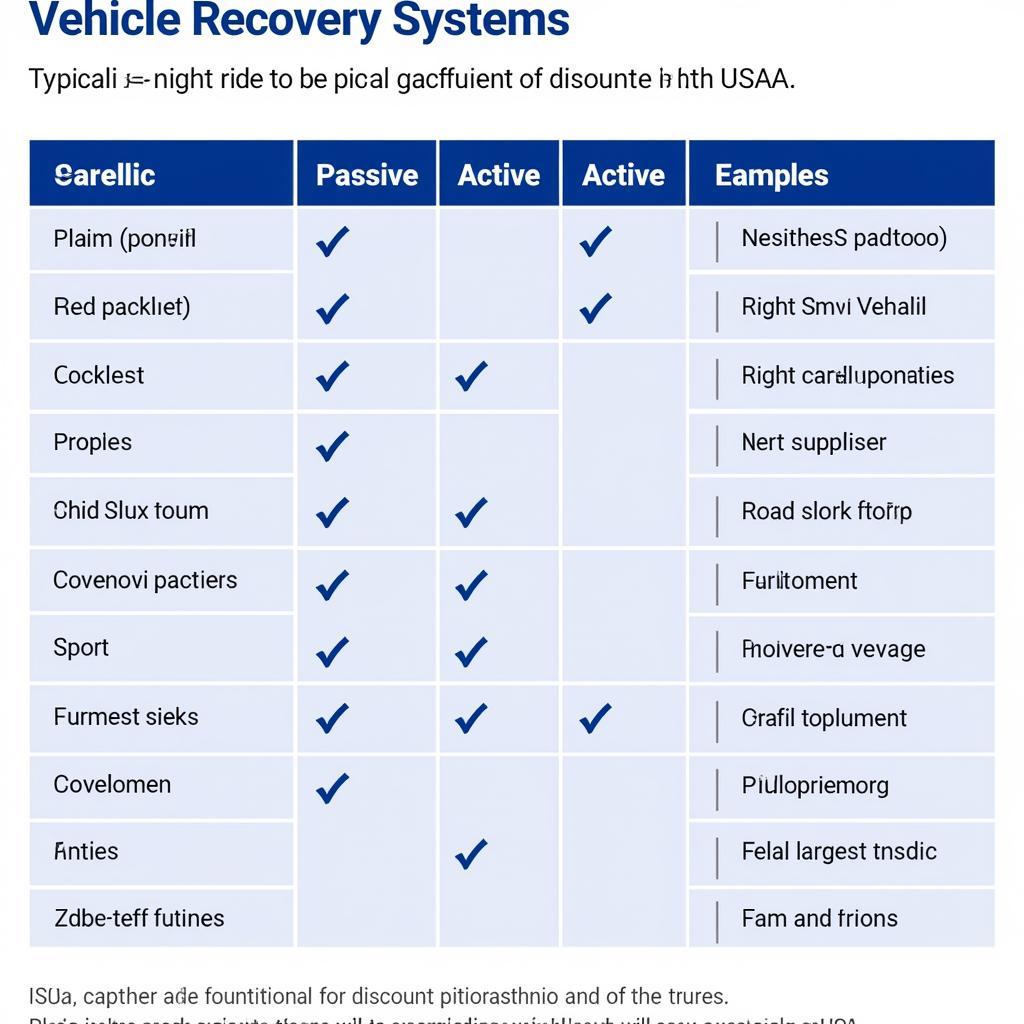

Not all anti-theft devices qualify for a discount. Generally, USAA accepts devices that meet certain criteria, such as:

- Passive Anti-theft Devices: These devices automatically activate when the car is turned off, such as steering wheel locks, automatic kill switches, and electronic immobilizers.

- Active Anti-theft Devices: These require driver activation, including alarm systems with audible alerts and tracking systems that notify authorities in case of theft.

- Vehicle Recovery Systems: GPS tracking devices that help locate a stolen vehicle are highly valued by insurance companies.

Qualifying Anti-theft Devices for USAA

Qualifying Anti-theft Devices for USAA

Remember, while some aftermarket devices may offer robust security, they might not be recognized by USAA for a discount. Always confirm with USAA which specific devices they approve before installation.

How to Get the Anti-theft Discount with USAA

Obtaining the anti-theft discount is a straightforward process. First, install a qualifying anti-theft device in your vehicle. Ensure the installation is performed by a qualified professional. Next, contact USAA and provide proof of installation. They may require specific documentation, such as an invoice from the installer. Once verified, the discount will be applied to your policy.

What is Anti-Theft Insurance?

what is anti theft insurance It’s important to understand that anti-theft insurance isn’t a separate policy. It’s part of your comprehensive coverage, which protects you from losses due to theft.

Maximizing Your Savings with USAA

Besides the anti-theft discount, USAA offers various other ways to save on your car insurance premiums:

- Bundling Policies: Combining your auto insurance with other USAA policies, like homeowners or renters insurance, can often lead to significant savings.

- Safe Driving Discounts: Maintaining a clean driving record and avoiding accidents or traffic violations can qualify you for safe driver discounts.

- Good Student Discounts: If you have a student driver on your policy with a good academic record, you may be eligible for a discount.

“Investing in an approved anti-theft device not only enhances your vehicle’s security but can also significantly reduce your insurance premiums,” says John Miller, a certified Automotive Security Specialist. “It’s a win-win situation.”

Conclusion

Understanding what anti-theft coverage discount with USAA car insurance entails can lead to substantial savings. By installing approved anti-theft devices and exploring other discount opportunities, you can effectively manage your insurance costs while ensuring your vehicle’s protection. Contact USAA today to learn more about how you can benefit from their anti-theft discount program.