Car theft is a significant concern for many vehicle owners, and anti-theft devices offer a layer of protection. But a common question arises: will anti-theft devices raise your insurance premiums? The answer, in most cases, is no. In fact, they can often lower your premiums. Let’s delve into the intricacies of this topic and explore how anti-theft devices impact your insurance costs.

How Anti-Theft Devices Affect Your Insurance

Insurance companies assess risk. A car with added security measures is statistically less likely to be stolen, and therefore, less risky to insure. This lower risk translates to potential discounts on your premium. The type of device, your vehicle’s make and model, and your insurance provider all play a role in determining the discount amount. Some insurers offer discounts for factory-installed devices, while others extend the benefit to aftermarket systems as well.

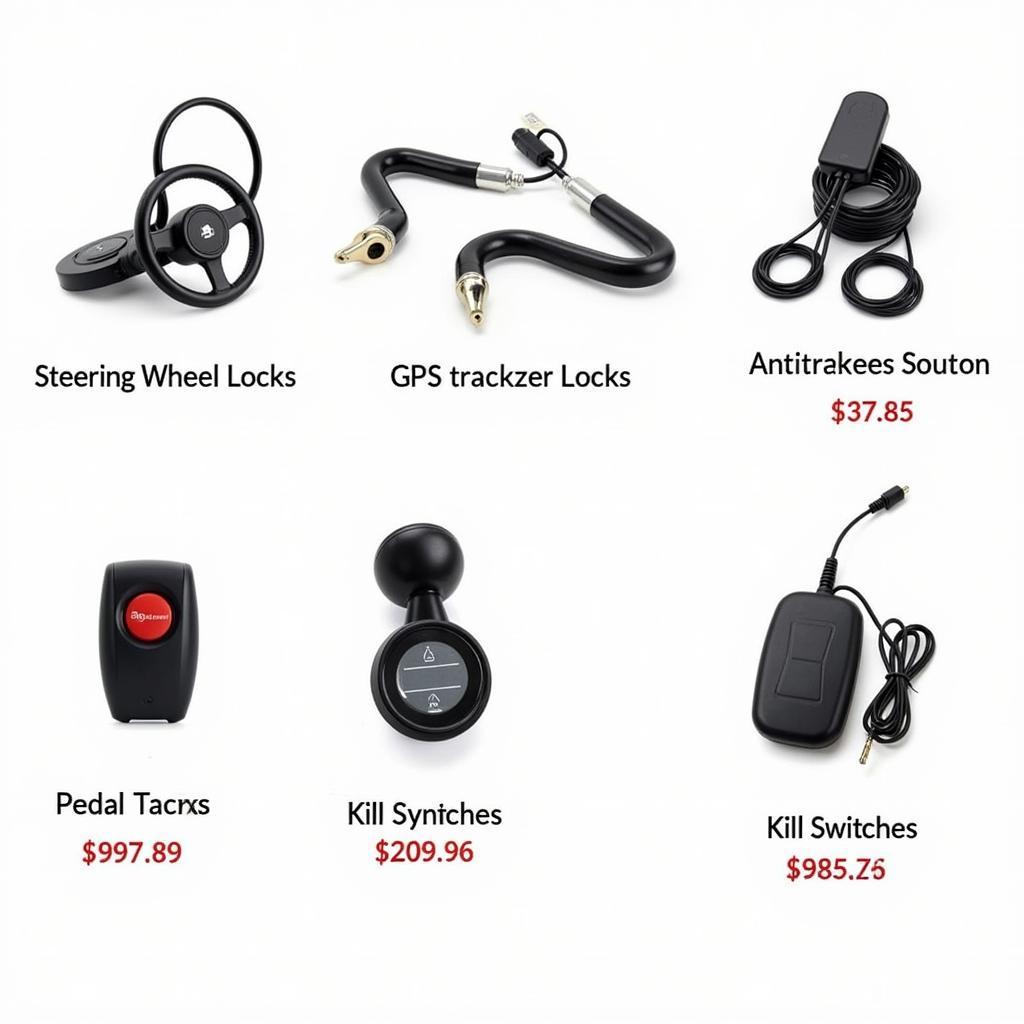

Types of Anti-Theft Devices and Their Impact on Premiums

Different anti-theft devices offer varying levels of protection, impacting the potential insurance discount. Basic alarms might offer a small discount, while more advanced systems like GPS trackers or immobilizers can lead to more significant savings.

- Alarms: Audible alarms deter thieves by drawing attention to a theft attempt.

- Immobilizers: These devices prevent the engine from starting without the correct key or code, making it extremely difficult to steal the car.

- GPS Trackers: Allowing for vehicle recovery in case of theft, these devices can significantly reduce insurance costs.

Some insurance companies require proof of installation for aftermarket devices to qualify for a discount. Always check with your specific provider for their requirements. For instance, certain Tesla vehicles come equipped with advanced security features that can influence insurance rates. You can learn more about Tesla’s low-voltage battery warnings on the Model 3 and Model S at tesla model 3 low voltage battery warning and tesla model s low voltage battery warning.

Will Anti-theft Devices Raise Premiums?

While highly unlikely, certain scenarios could lead to a slight premium increase. For example, if you install a highly sophisticated system that requires specialized maintenance, your insurer might factor that into your premium. However, this increase would likely be minimal compared to the potential savings from reduced theft risk.

Why Invest in Anti-Theft Devices?

Even if the discount isn’t substantial, the added security and peace of mind are invaluable. Knowing your vehicle is protected can significantly reduce stress and worry. Plus, a recovered stolen vehicle often incurs damage, and the claims process can be time-consuming. An anti-theft device can help prevent this altogether. If you’re experiencing a low-voltage battery warning on your Tesla Model 3, you can find helpful information at tesla low voltage battery warning model 3.

Different types of car anti-theft devices with price tags

Different types of car anti-theft devices with price tags

“Investing in an anti-theft system is a proactive step towards protecting your vehicle and potentially lowering your insurance costs,” advises John Davis, Senior Automotive Security Consultant at SecureAuto Solutions. “It’s a win-win situation for most car owners.”

Negotiating Insurance Discounts for Anti-Theft Devices

Don’t be afraid to negotiate with your insurance provider. Provide them with details about the installed device and inquire about applicable discounts. Sometimes, proactively asking is the key to unlocking savings.

“Many drivers overlook the potential discounts available for anti-theft devices,” says Sarah Miller, Insurance Specialist at AutoQuote Pro. “It’s always worth discussing with your agent to see what savings you can qualify for.”

For Tesla owners concerned about battery drain in hot weather, check out tesla battery drain in hot weather. Also, for general information on Tesla’s low voltage battery warnings, visit tesla low voltage battery warning.

In conclusion, anti-theft devices rarely raise your insurance premiums. In most cases, they offer valuable discounts and enhance your vehicle’s security. By understanding the types of devices available and actively engaging with your insurance provider, you can maximize your savings and protect your investment. Will anti-theft devices raise your insurance premiums? The answer is generally a resounding no, making them a smart choice for any car owner.